Dear Clients, Colleagues, and Partners,

As I write my fourth annual letter to you as the CEO of SERHANT., I cannot help but marvel at the incredible journey that has defined us thus far. This year we experienced monumental growth and discovery in a year defined by economic and market adversity. Although interest rates have begun trending down, we spent the majority of 2023 answering the question: How do we prosper and provide the utmost benefit to our customers in a market where affordability is at a four-decade low? I owe an enormous debt of gratitude to our agents, clients, friends, colleagues, and advocates. Your trust, support, dedication, and unwavering belief propel us to set the pace for success in our industry, regardless of the market's twists and turns.

“Markets do not dictate your outcome; markets dictate your strategy.”

2023 marked a mercurial year with many challenges: runaway inflation, 20-year high interest rates, financial market turbulence, regional bank failures, ballooning national debt, a housing affordability crisis, major trade organization strikes, devastating natural disasters, and wars on multiple fronts. On one hand, 2023 was awful. On the other, the year felt very much like the Tuesday after a Black Friday and Cyber Monday sale.

What goes up (the roaring 2020-2021 market) must come down (2022-2023). But what goes down, does not stay down forever. This year has also seen triumphs; the World Health Organization declared the end of the COVID-19 global health emergency, we saw U.S. fiscal policy success (including enduringly high employment rates), there have been major climate wins, and society is integrating incredible generative AI tools with the potential to transform how we live and work. There are uncertainties on the horizon, and there always will be. Still, we have so much to be encouraged about, and given what we’ve already achieved in the face of enormous difficulties and what lies ahead on the horizon, my boundless optimism and enthusiasm for the future is more explosive than ever. Together, we will forge ahead in the face of any obstacle, relentlessly transforming challenges into opportunities.

This year, amid the slowest national home sales volume on record since the market crash in 2008, SERHANT. has not only weathered the storm, but we are breaking new ground and expanding at a breakneck pace. We built this firm to sit at the intersection of brokerage, media, education, and technology not only because we thought that flywheel would be the most successful, but that it provided us with the most unique hedge in the industry against market fluctuations. Because when others pull back, we push forward:

We climbed from #11 to #6 on The Real Deal’s annual Top Manhattan Residential Brokerages list and reached #5 in Brooklyn.

We opened SIX additional states (Connecticut, New Jersey, Pennsylvania, North Carolina, South Carolina, Florida) and increased transactions by 63% YoY.

Sell it Like Serhant crossed 21,000 enrollees, released their 8th signature course,entered their 126th country, all while growing MRR 40%!

Two more SERHANT. Houses opened in the Hamptons and Miami, representing the physical footprint of the “brokerage of the future” concept.

We’ve doubled our agent count to nearly 500 dedicated souls as we continue to attract independent brokerages that have resisted joining other major firms, and we’ve doubled our staff to 113 exceptional team members.

We closed over 1,500 deals for nearly $3B in total transactions.

SERHANT. Signature, our high-net-worth platform for deals over $10M, had a record year, including the $50M sale of the Penthouse at 151 Wooster, a record-breaking sale at 520 Park, a $31.5M Penthouse sale at 157 West 57, an $18.5M sale for a townhouse at 24 West 10th, the over-ask $16.3M deal at 159 East 61st, and more across all of our markets.

SERHANT. New Development signed 20 new buildings, representing a staggering $1.426 billion in inventory for 2023. We also walked away from projects for the first time! We signed our largest project yet in 2023, a billion-dollar tower in Brickell, Miami – coming to market in Q1 2024. We launched our Leasing Division with large projects in NY, such as The Laney and 475 Kent, as well as Kushner’s WyndMiami. As a result, we’ve doubled the size of our new development corporate team, adding planning, design, and business operations departments.

SERHANT. Commercial launch and currently holds $400 million in commercial listings.

We hosted our biggest event ever between the brokerage and SERHANT. Ventures: SellIt 2023 in Miami with over 500 attendees.

SERHANT. Studios debuted our first national commercial, increased their brand offerings, introduced "multilingual property tours," and won yet another Shorty award for our real estate content.

We wrapped the year with our first annual SERHANT. S.ERVES day on December 14th, giving back to the communities in each market we proudly serve, positively effecting the lives of over 10,000 people!

I take the responsibility of my influence very seriously and am fully committed to using it for good — for the world at large and indeed for the good of SERHANT. I have had the opportunity to teach, share, and inspire prolifically. This year alone, I have given keynote speeches all over the world, including in Australia and Monaco and Abu Dhabi; launched a new podcast, Business of Influence, with some great guests; made a cameo on Sex and the City’s revival, And Just Like That…; shot a profile for NY Magazine; was the subject of a Harvard Business School case study on time management for success; wrote my third book, Brand it Like Serhant (coming out Feb. 6, 2024), and filmed a new show that we can’t talk about yet… but get ready! Each of these endeavors has expanded the body of knowledge I share with the world while simultaneously expanding my influence to the benefit of SERHANT.

As we turn our gaze toward 2024, we're not just anticipating change; we’re driving it. As the world evolves, we constantly strive to stay one step ahead, innovating for the future, sharing every bit of what has driven our successes, and becoming the change we wish to see. We stand on the brink of a historic technological revolution, and I fearlessly commit to leveraging available resources in the present while keeping a keen eye on the boundless potential of the future.

“The greatest danger in times of turbulence is not the turbulence – it is to act with yesterday’s logic.”

– Peter Drucker

As you peruse this letter, please explore the linked resources and visual aids to dive deeper into each topic that interests you. The sections of this letter are linked above for simplified browsing. As always, the thoughts and opinions expressed here are my own, and represent my expectations and convictions based on extensive research and lived industry experience. As we build for the future, we must extract every lesson from the past and present to arm ourselves as leaders and innovators in the ever-evolving real estate landscape. Buckle up, and let's continue to enjoy this thrilling ride together!

Ryan Serhant

US Economic Update

The U.S. economy has experienced complex and confounding dynamics in 2023 that will carry into the next 12 months and beyond. COVID-19 broke the standard market model, influencing trends and behaviors of all market players, from the government to institutions to everyday consumers. Steve Eisman, best known for predicting the 2008 market crash, said of Fed Chairman Jerome Powell recently: "I think he's just as confused by all the different data points as everybody else…" This remark is sobering, and yet, the confusion revolves mainly around how and why the economy remains so resilient in the face of headwinds and traditional predictors of recession. Perhaps it’s the +$800B in personal savings accounts or the $6 trillion in total assets sitting on the sidelines? Or perhaps it’s that we’ve seen this movie before?

The Fed, Inflation & Where is our Recession(?)

This time last year, the national consensus was that the U.S. would see a recession within the 12-month period that’s now ending. Even Michael Burry bet 90% of his portfolio on a stock market crash! We have not only managed to avoid a recession in 2023 (so far), but we have also seen improved prospects of a potential recession in the near future (more on that below). The E.U. and New Zealand both fell into recession in 2023. Australia, China, and several G7 nations, including the U.S. remain at risk of recession.

“Given the ongoing war in Ukraine, the conflict between Armenia and Azerbaijan, and the fast-evolving war in the Middle East, companies should stay alert to geopolitical fragility. The possibility of a larger Middle East conflict remains, and its impact could reach across the world, most immediately via oil prices.” [Karen Harris, Dunigan O'Keeffe, Jeffrey Crane, and Jason Heinrich for Bain & Company]

However, after assessing those risks, according to the U.S. Department of the Treasury’s report on the IMF’s World Economic Outlook,

“The U.S. economy in 2023 outperformed expectations along three key dimensions: growing economic output, labor market resilience, and slowing inflation […]. The progress we have made on growth, labor markets, and inflation stands out across the globe, and remains an important source of strength for the global economy.”

In the face of inflation reaching a 40-year high at 9.1% in June of last year, the Fed was challenged with a dual mandate: tame inflation back to a target of 2% and simultaneously protect the labor market by keeping it at full employment in order to achieve a “soft landing,” defined by taming inflation without triggering a recession. So far, while not painlessly, the Fed has achieved these goals. Chicago Fed President, Austan Goolsbee, spoke on Inflation in November:

We may reduce inflation at a rate equal to the fastest falling inflation rate in the last 100 years. There has never been an inflation decrease to this magnitude without a major recession, but because of some of the strangeness of this market, a soft landing is still possible.

Prices are decreasing everywhere. The Fed has accomplished a great deal in its mandate to lower inflation, with the Consumer Price Index (CPI) reduced to 3.1% in November of this year as a result of the rate hikes and “higher for longer” mandate the Fed implemented. Because of the success in taming inflation, the Fed has signaled, and the market is betting, that rates will begin to come down in 2024. I agree with that bet, and I expect we will start seeing rate cuts as early as Q1, in what history might define as the “Biden Bump.” Fed Chair Jerome Powell has remained stern in his stance, however, stating that the Fed is “fully committed” to returning the inflation rate to 2%, and despite welcoming decreased inflation readings over the last few months and expecting to cut rates three times in 2024, they, “will need to see further evidence” that they are well on their way to their target inflation rate, and are “prepared to tighten monetary policy further, if necessary”.

The Fed is determined not to make the same mistake that Fed Chair Paul Volcker made in the 1980s, bringing rates back down too soon and triggering the resurgence of inflation. It’s no longer a conversation about how high to raise rates but how long to keep rates elevated, and whether the Fed can accomplish a Goldilocks situation – not doing too much, or too little, but rather, just enough to accomplish a soft landing. And yet, the risks associated with triggering a recession by keeping rates too high for too long are also numerous - a fact the Fed is well aware of and has been adept at navigating thus far.

One consequence of high rates is restricted access to, and demand for, credit. Banks reported that 3rd quarter lending standards remained tight and loan demand remained low, although both measures improved slightly over Q2 reports. This could be a recession warning sign as fewer businesses and consumers make larger purchases and are able to cover their balance sheets with the use of credit. Simultaneously, banks cannot overextend themselves on loans that may not perform at the risk of going under — especially as small and medium-sized banks are facing loans coming due on struggling commercial office space over the next couple of years since bank failures, too, are an element of a recession. While rates are currently poised to come down in 2024, it will take months or even years for consumers and businesses to adjust to the “new normal” after growing dependent on the rock-bottom rates of the last decade. Stabilizing these risks is the record amount of cash being held on the sidelines or in savings and money-market accounts by individual and institutional investors.

Recent Fed data indicated a 37 percent increase in median American net worth from 2019 to 2022. Various factors have contributed to boosting consumer spending, a major driver of the economy's growth. While many Americans have undoubtedly felt the pressure of two years of high inflation, average pay surpassed price increases, enhancing people's spending capacity. In the July-September quarter, consumers demonstrated lavish spending on both goods and services. Factors like Taylor Swift and Beyonce’s blockbuster concert tours and wages increasing 1.2% in the third quarter after climbing 1.0% in the second quarter for a total of 4.6% YoY [Reuters] have bolstered consumer spending. Much of this spending is happening in cash rather than with credit, resulting in more money in circulation, which was exactly what the Fed intended when it raised rates to make credit less available and attractive.

The New York Times highlighted the challenges slated to arise in the fourth quarter, including savings depletion, the resumption of mandatory student loan payments, and the need to refinance maturing corporate debt at higher rates. In October, unemployment had increased by 0.5% to 3.9% since December of 2022, and some analysts are saying that an increase of half a percent has foreshadowed many previous recessions. [Bureau of Labor Statistics] While unemployment has since fallen 0.2 percentage points to 3.7% in November and we are still below the natural rate of unemployment and the long-term average rate of unemployment in the U.S., December has seen several companies initiate massive layoffs, and December unemployment numbers won’t be known until the New Year.

According to the Bureau of Economic Analysis (BEA), as reported by FannieMae, real disposable personal income contracted by 1.0% annualized over the third quarter. The personal saving rate was just 3.8% in October, not its lowest of 2023, but down from 5.3% in May, potentially leaving limited room for further outperformance of consumption relative to incomes. Although as the holidays approach, there is buzz that consumer spending is surprising retailers by holding stronger than expected. The third-quarter growth figures also revealed increased spending by the government and businesses building up their stockpiles, but economists caution that such inventory increases are unlikely to be sustained. As pointed out by Bloomberg, should demand persist, there is a risk of inflation staying above the central bank's 2% goal, potentially leading to a need for tighter monetary policy.

Via PWC

U.S. Personal Savings Rate via ycharts.com

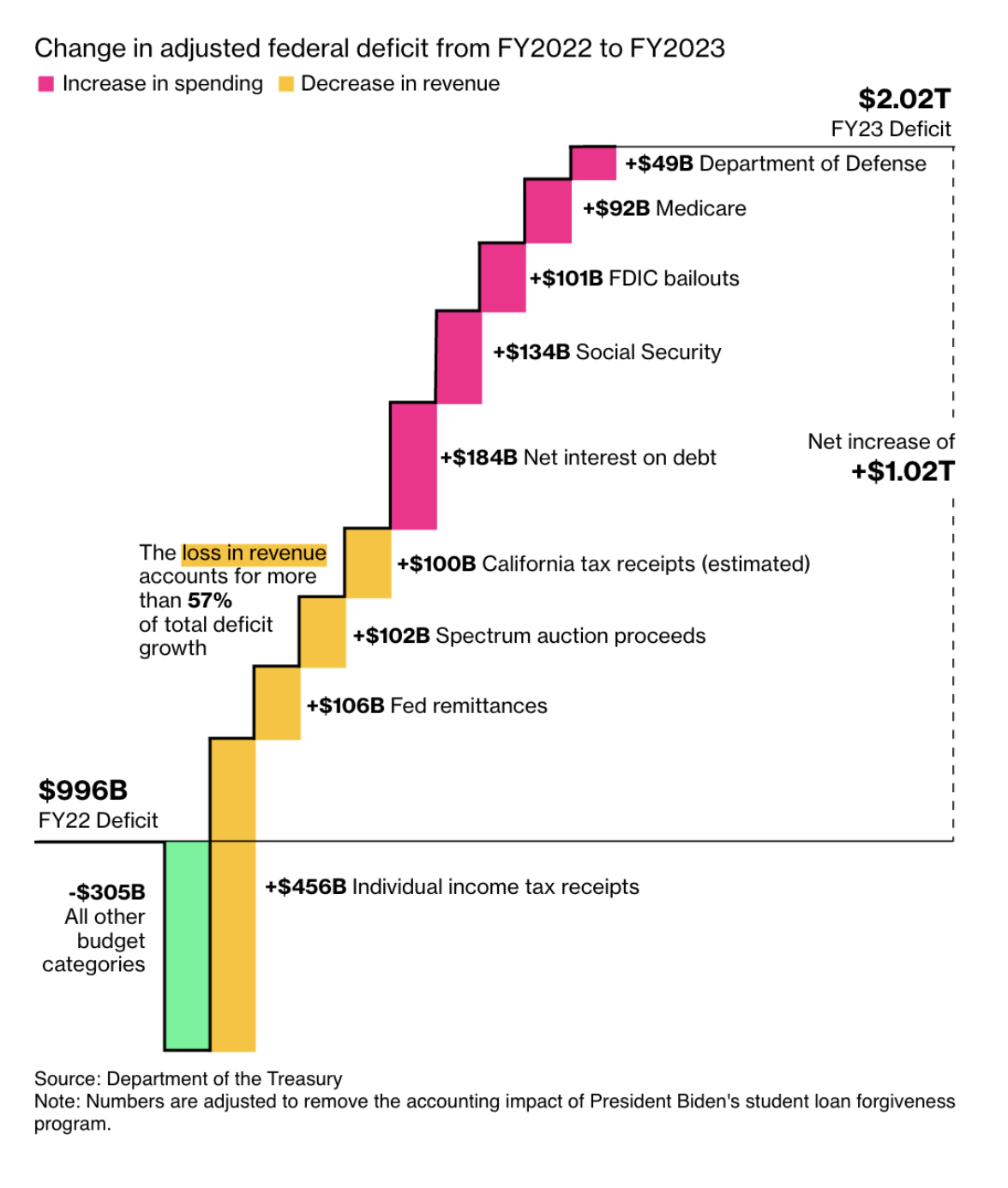

Government spending accounted for 17.3% of GDP growth in the 3rd Quarter [Federal Reserve Bank of St. Louis], with the defense sector contributing to the greatest increase in spending. Notably, the Federal Deficit roughly doubled in the fiscal year through September of this year, in large part because of decreases in revenue as opposed to spending increases (which are not to be ignored). This is an important caveat, as a recession is defined by two or more consecutive quarters of GDP shrinkage. However, while government spending is boosting GDP, increasing government debt directs investment away from capital goods, reducing output and thereby harming the overall economy. The deficit is a situation likely to worsen, given the partisan budget battles in DC.

Via: Bloomberg

Estimates suggest that the impact on GDP from tightening financial conditions can take anywhere from one to two years to be felt. As the Fed began raising rates in April of 2022, it could still be well into next year before the force of higher rates is fully felt, a fact Fed Chairman, Jerome Powell, acknowledged in his remarks following the December 13th Fed meeting. Piper Sandler’s Nancy Lazar noted that “it isn’t taking ‘longer than usual’ for the Fed’s hikes to have an effect; the historical average since 1958 is that it takes ten quarters from the first hike to the recession. We’re only six quarters in right now.” [CNBC] Higher borrowing standards and costs restrict capital expenditure and hiring, impacting both GDP and employment numbers negatively, and potentially raising red flags for recession. In Q3, recession odds through next September dropped to 46%, down from an average forecast of 59% last quarter. [Bankrate] Many forecasters are no longer predicting a recession, and as Mark Hamrick, Bankrate Senior Economic Analyst went on record to say:

Economists who do expect a recession say a downturn could begin at some point in the first half of 2024. But most note that the impact would likely be modest, resulting in fewer job opportunities but lower unemployment that might help Americans find new positions relatively quickly even if they are laid off.

As I pointed out in a LinkedIn article that I penned last year, we’ve been anticipating our next recession for years. Since 2018, in fact! That has given us ample time to prepare (and save!) allowing for a more minimal impact. Getting punched in the nose always hurts, but not nearly as much when you know it’s coming and you’ve had 5 years to prepare for it! The three largest crises the U.S. has faced over the last 25 years — 9/11, the 2008 financial crash, and COVID-19 – were all unexpected, leaving us unprepared to do anything but react.

Indeed, COVID took the U.S. by surprise, triggering the inflation caused by the Fed’s stimulus plan, pent-up demand and supply chain issues, but the Fed has had plenty of time to strategize and execute a strategy to lead the U.S. to a soft landing, and they have proven their competence in doing so, thus far. Recessions affect our financial system like winters affect our weather patterns – inevitable with variable impacts. We need not fear them; we simply prepare for them.

The 2024 Presidential Election’s Impact on Financial Markets

Of course, the upcoming 2024 presidential election exerts tremendous political pressure on the incumbent democratic party to avert a recession in the coming year. This will be central to the campaigns of all candidates (which is why I’m predicting a Biden Bump Fed rate cut in Q1), as the economy is certainly the top issue on the minds of voters. In a poll conducted by Bloomberg with over 5,000 swing state voters, nearly 40% of respondents rated the economy as their number-one concern in the upcoming presidential election.

The economy’s prominence as a contentious campaign issue isn’t new, and its undeniable influence on the mindset of consumers, investors, and the market's collective consciousness makes it a topic worthy of discussion.

According to Nationwide's ninth annual Advisor Authority survey, irrespective of political affiliation, almost half (45%) of investors believe that the outcome of the 2024 U.S. federal elections will have a more significant impact on their retirement plans and portfolios than market performance. Beyond concerns about the election's impact on retirement prospects, investors express apprehension about the effects of new policies and potential shifts in party rule on the U.S. economy. A substantial portion (32%) of investors anticipate a recession within 12 months if the political party least aligned with their views gains more power in the 2024 federal elections. Similarly, 31% believe that a change in the party they least align with will have negative repercussions on their future finances, with an additional 31% expecting an increase in taxes within the same timeframe. Mark Hackett, Chief of Investment Research for Nationwide, cautions against letting partisan instincts overshadow historical evidence, noting that election results, regardless of the winning party, have little impact on future investment returns. [PRNewswire]

Despite inflation and high interest rates persisting into 2024, there are still a lot of reasons to be optimistic. “In recent months, price growth has slowed while employment has remained high. The so-called misery index — the unemployment rate combined with the inflation rate — is now at a lower level than it had reached during the reelections of Ronald Reagan, Bill Clinton, George W. Bush, and Barack Obama.” [NYMag] This hinges on the Fed accomplishing a soft landing, reducing inflation, and preventing a spike in unemployment.

Regardless, election years tend to impact public opinion and cause individuals to hold off on making major financial decisions, which can then, in turn, affect the markets. “Like it or not, 2024 is a general election year, which will keep politics and government in the headlines…” says Bankrate’s senior economic analyst Mark Hamrick. “The news cycle and a range of looming uncertainties could provide the foundation for volatility.” [Bankrate] After all, this conversation isn’t about the market influencing people’s voting decisions — in our political climate, those decisions have long been made — it’s about how the election year will impact the economy and, in large part, what actions the Fed will take regarding those impacts.

Investment Markets

The Fed’s job is to act, and the market’s job is to react, and so it goes.

Due to the size of the deficit, the U.S. government has had to issue treasury bonds to cover the shortfall. Bill Merz, head of capital markets research at U.S. Bank Wealth Management noted:

New Treasury bond issuance must grow due to a combination of deficit spending [...] and the higher interest costs associated with today’s elevated interest rates,’ At the same time issuance is up, the Fed, as part of its monetary tightening policy, began allowing its large portfolio of U.S. Treasuries and agency mortgage-backed securities to mature. ‘That means other investors need to absorb the growing Treasury supply and to do so, they have demanded higher yields,’ says Merz. [Bloomberg]

Higher interest rates create a vicious cycle as the increased interest costs add to the deficit, which in turn requires more debt to be sold — the more debt that is sold, the lower the demand, and the lower the demand, the higher yields must be to attract investors. Fortunately, bond yields are now beginning to decline as the Fed is expected to cut rates in 2024.

As of mid-December, the S&P 500 surged to near-highest-ever levels and the Dow set a new record, which all but erased the pain of 2022’s lows. The Fed’s December 13th meeting was the source of market euphoria and the S&P 500 closed the day at a total gain of 17.82% YoY, while the Dow closed the day up nearly 12% YoY.

S&P 500 - 1 Year [Via Google Finance]

Dow Jones Industrial Average - 1 Year [Via Google Finance]

Due to stock volatility over the last two years, fewer companies have chosen to go public. There is typically an onslaught of IPOs just before the holiday season, and this year, it’s been minimal. “The bad companies can’t go public, and the good companies don’t want to go public in a bad market,” Matt Kennedy from Renaissance Capital recently said. There have been 152 IPOs on the U.S. stock market in 2023. As of December 15, 2023, this is 13.64% fewer than at the same time in 2022, which had 176 IPOs by mid-December. [Stock Analysis] 2020 first beat the record for most-ever IPOs in a year at 480, quickly eclipsed by 2021’s 1,035. The last two years' performance has been disappointing by comparison. IPO candidates choose to reconsider or delay their public offerings rather than risk a poor debut, but that leaves them hoping their venture capital funds will keep flowing in the meantime or searching for interested parties for mergers; otherwise, they risk going under.

Crypto

If you’ve read my previous annual investor letters, you’ll know that I’m a fan of crypto. And while controversy and legal challenges embroil the crypto industry, causing naysayers from Bob the Builder to Jamie Dimon to question its relevance, crypto isn’t going anywhere. The most popular cryptocurrencies, Bitcoin and Ethereum, which tend to follow a similar trajectory, have been trending higher throughout 2023 after last winter’s “Crypto Winter,” due to improving optimism about the U.S. economy. Both currencies traded mostly sideways all year but spiked in late October in anticipation that the U.S. Securities and Exchange Commission (SEC) may soon approve the first-ever Bitcoin spot exchange-traded fund (ETF) to trade on a major U.S. exchange after long rejecting ETF applications on the grounds that they did not meet investor protection requirements.

Experts estimate a 90% chance of the SEC approving a spot Bitcoin ETF by January 10, 2024. [Forbes] This optimism has already begun to unlock major pent-up demand for crypto, with Bitcoin seeing its “largest run since the crypto bull market of late 2021.” [Bloomberg] “Demand for a bitcoin ETF, which would allow retail and institutional investors to easily bet on the price of the world's biggest cryptocurrency is expected to draw in as much as $3 billion from investors in the first few days of trading and pull in billions more thereafter.” [Reuters] And I would be remiss, in my role as the CEO of a sales training platform, if I didn’t state that the reason the ETF will succeed won’t be because of the utility of Bitcoin, but because of the thousands upon thousands of commissioned sales people who will immediately start selling it to their customers.

Source: Coindesk

This is not to downplay the risks of crypto; the SEC has taken enforcement action against major firms Binance and Coinbase this year, many firms have failed altogether, individual investors have lost fortunes, and institutional investors have moved billions of dollars out of crypto. And, of course, there’s the conviction of Sam Bankman-Fried, founder of the now-debunked FTX exchange. Speculative gambles drive crypto and expose it to vulnerability from fraud, scams, and illegal/untoward activity. A vulnerability and benefit of crypto is that it allows money to flow freely to people without access to stable banking. Sometimes, these recipients may be refugees and charitable organizations, while at other times, they could very well be bad actors on the black market.

Crypto is an industry in its relative infancy, and there are many kinks to work out. It’s my opinion that each act of legislation and each move by the SEC is moving further in the direction of clarifying crypto's role in the market and codifying it into the modern financial landscape.

Cash on Sidelines and Banking

The situation with high interest rates and economic turbulence has, of course, impacted investors’ overall strategies. As of now, a record $5.6 trillion is currently held on the sidelines by cautious investors in relatively stable and liquid money market accounts. [U.S. Bank] With interest rates as high as they are, many investors are taking a “why take the risk?” approach. The adage that you “can’t save your way to retirement” may be true, but losing your hat is an even worse option. While banks are slower to pass along the Fed’s high rates on traditional savings accounts, money market accounts are yielding elevated rates of return than they have in many years and proving a good alternative for risk-averse investors, at least for the time being. Once rates start to come down, experts say as much as $1 trillion could immediately flood the markets.

The performance of money market portfolios caused losses in institutional securities portfolios. Concerns arose that the Fed’s higher-for-longer policy could cause additional outflows and “even more losses on the banks’ security holdings necessitating more funding for replacement. Short-term markets are showing that banks are starting to pay up to protect their cash holdings from sinking and to safeguard against future runs on deposits.” [Bloomberg]

Banks are at particular risk over the next couple of years due to their share of commercial real estate (CRE) loans. As office buildings sit empty due to the move towards a work-from-home culture, rental income yields have plummeted, causing the price a potential investor would be willing to pay for the property to decrease, as well. Properties that are now underwater are unsellable, and many owners have allowed their lenders to foreclose. With many loans on commercial properties coming due over the next couple of years, many more will likely be slated for foreclosure as investors refuse to pump more cash into these vacant and unwanted properties.

Regional and small-to-medium banks hold an outsized number of loans on commercial office properties. Consequently, they might face trouble as these loans become nonperforming and owners opt not to refinance upon maturity. The media discussions are centered on the unrealized losses that banks are facing. While some banks are well-funded to cover these losses, others may not fare as well, similar to the case with the regional Silicon Valley and Signature Banks.

Alternative Investments: Real Estate

As a real estate broker, I must point out the obvious opportunity in real estate investment. Typically, when we speak about real estate as an alternative investment, we’re talking about commercial real estate, real estate investment trusts (REITs), and debt servicing — all great options if navigated correctly. These are categories that everyday investors are involved with, but the primary investors that target these investments are institutional.

However, private individual investors hold much of the cash on the sidelines in money market accounts that we’re discussing. While cash on the sidelines may be being put to work in other places, now is a good time to consider working to liquefy those assets to reinvest in real estate while market volatility works itself out and we move toward presumed lower mortgage rates and increased demand for real estate. Investors still maintain a high degree of interest in real estate investments but, due to low inventory and high prices, have taken a “wait and see” approach. As rates stabilize and potentially move lower, demand will surge, and I’m betting on prices resuming their upward trajectory from there. For investors with cash on hand, this opportunity to realize appreciation in the short term should prove attractive.

This strategy is successfully being implemented by many. Before COVID, around 30% of the deals in the markets we serve were all-cash. Today, that number is over 60%, and over 70% in the luxury market.

As for the commercial sector, this Bloomberg article is required reading for anyone seeking to quickly understand the challenges facing CRE today —in particular, office buildings. Many challenged buildings have the option of retrofitting as residential units if zoning permits, or as shared workspaces. However, developers may need to demolish many of these properties to create space for more in-demand uses. Both retrofitting and demolishing pose challenges, encompassing not only regulatory restrictions but also issues of embodied carbon, which shareholders and governmental policies alike are increasingly seeking to address. Investors with risk tolerance, a vision, and an interest in distressed assets will find opportunities.

I wrote about this on LinkedIn earlier this year as the headlines about failed banks were circulating:

If we can't trust banks, the stock market, or cash to keep our dollars safe, what do we do with our money? With the recent collapses of Silicon Valley Bank (SVB) and Signature, people are scratching their heads, wondering what to do next. And although there's no magic bullet, real estate offers a better answer. Here's the deal: unlike cash, which is backed by lousy, devalued bonds, real estate is backed by the property itself. [...] Real estate will represent a golden opportunity. When people want a secure investment, real estate prices are going to soar.

Real Estate Industry Update

Commission Lawsuits

Following a recent verdict in a Missouri case that awarded a class of plaintiffs $1.8 billion in damages, several copycat lawsuits now aim to change how most real estate agents are compensated. The Department of Justice (DOJ) has also taken an interest in the matter. These lawsuits target the National Association of Realtors (NAR), the industry's largest trade organization, and several big residential real estate brokerages, accusing them of violating antitrust laws. The cases center on the buyer-broker commission rule, which requires sellers’ agents to offer compensation to buyers’ representatives as a condition of offering the property for sale on a multiple listing service (MLS). This standard allegedly leads to a situation in which many listing agents may charge similar commission rates — which are always negotiable, an important note in this case — to cover their expenses and offer a fair commission split to the buyers’ agent.

Under the existing system, the commission split is seen as necessary to the listing agent’s fiduciary duty to their clients and marketing of their property to avoid any disincentivization on buyers’ agents' part to show their clients’ listings. The buyer-broker rule, in theory, is meant to encourage fair competition and a level playing field while avoiding a situation in which home buyers’ out-of-pocket expenses are restrictively high, as effectively the buyer’s agent commission is baked into the sales price of a home and thereby included in the borrower’s mortgage. Critics say that the buyer-broker commission rule forces sellers to pay the buyers’ agent, who provides no services to the seller themself and doesn’t allow them the option to decline to pay that expense.

If the lawsuits are successful, as the Missouri case was, it could have far-reaching implications for how the real estate industry operates, not just for professionals but for buyers and sellers alike – from agency relationships to the importance of MLS tools in marketing and searching for homes, and even how homes are priced. NAR announced changes to its rules, allowing agents to list homes on the MLS, offering $0 in commission to the buyers' agents.

My supposition is that buyers' agents will begin to negotiate their compensation directly with buyers, and buyers will then negotiate with sellers to pay their commission costs with a credit at closing. In a hot market, commissions are often negotiated. But in a slow market, incentive must be created to unlock a seller’s equity in their home. Depending on how this plays out, compensation rule changes could mean buyers are spending even more on their property purchases and cash-at-closing at a time when affordability can already be highly challenging.

REBNY, New York City’s most influential trade organization, has already acted and, as of Jan. 1, 2024, will prohibit listing brokers from splitting commissions with buyers’ brokers, although they will allow a seller to pay a buyer’s commission should the seller choose to. Listing agreements will now clearly define a seller’s offer of compensation directly to the buyer’s broker and listing broker, respectively. Under this arrangement, a seller could choose not to offer the buyer’s broker a commission at all, and the buyer and their agent would negotiate the payment of the broker's commission directly, or in the case that the buyer’s broker was unwilling to accept the seller’s offer of compensation. This will introduce additional interesting negotiation scenarios in the purchase and sale of residential real estate and generate additional competition between buyer brokers. REBNY’s actions might set an example for how other localities may resolve potential legal vulnerabilities exposed by these lawsuits. After all, if trade organizations meant to protect us ultimately expose us to legal and financial danger, their members will likely mass-exodus away from those organizations and the traditional model they represent.

One of SERHANT.’s core values is radical and exacting transparency. If I’d thought that the “traditional” brokerage model was the functional and correct choice for the industry and our clients, I would have joined a different firm rather than building my own from the ground up. I am all for any shake-up in the real estate industry that ultimately serves the industry itself and our clients better, more completely, and more honestly.

National Housing Market

When rates began rising in the spring of 2022, everyone expected home prices to decline. On average, across the U.S., they briefly did, but then unexpectedly they rebounded and even surpassed the highs of Spring 2022! At the end of 2022, everyone believed the Fed had finished raising rates and that rates may drop in 2023, however, the Fed hiked rates at 3 out of every 4 Fed meetings in 2023, totaling 525 basis points since March 2022. As rates rose, sales volume continued to dwindle but pricing, magically, continued to rise as inventory shrunk.

Housing analyst predictions are often wrong, as the market is less like a game of dominos and more like a Rube Goldberg machine. The variables are innumerable and unexpected events are a guarantee. That being said, trends unfold in ways that allow for some time to react and develop a strategy. Despite the unpredictability, no one at SERHANT. has been caught off guard by these market developments, and that has led to tremendous success for our agents and their clients, as one of our core competencies is creating wins in any market environment. As they say, 'There is no bad weather, just bad clothes.’ There are no market conditions in which there is no winning edge.

The challenge of our current market is one of affordability, caused by high mortgage rates and low inventory of homes for sale. Our inventory problem is two-fold. For one, the rush to purchase homes during the pandemic, when rates were at rock-bottom lows caused a surge in home trading that essentially amounted to 4 years worth of transactions in the span of only two years. Now, with high rates and affordability challenges, real estate trading activity plummeted, essentially evening out the earlier outsized years. In other words, everyone who intended to move has already done so. The second issue is what I call the golden handcuff effect. Homeowners have strong equity, but they’re locked in by their low mortgage rates — 90% of homeowners have a mortgage rate below 5%, and they’re wary of trading in those rates for the 6.5-8% rates available today. As the Fed appears to follow a ‘higher for longer’ trajectory with rates, analysts expect existing home sales and new listings to remain slow for the foreseeable future.

Home values will continue to rise in 2024, although likely more modestly, as affordability concerns cause buyers to be more selective and put an end to the rampant bidding wars of 2020-2022. Case in point, we are seeing an increase in both price drops on homes listed for sale. My expectation of more modest price gains in 2024 is supported by the fact that while inventory remains low (low inventory equals price growth), it has improved this year (slightly improved inventory will equal slightly slower price growth). “Inventory is approximately 46% below the historical average dating back to 1999,” says Jack Macdowell, chief investment officer and co-founder at Palisades Group. [Forbes] Strong new home construction has provided buyers with hope in the tight inventory environment, but the impacts of inflation and high rates are also reaching the new home construction sector, and new home starts were down by 7% year over year in September of 2023 from September of 2022. Refer to the chart below for insight into housing inventory over time.

Time is the most likely solution to this problem. In time, rates will come down, homeowners who bought in 2020-2022 will approach natural turnover rates, reaching a tipping point in their evolving housing needs, and more homes will be listed for sale. As painful as low inventory has been, we do not want an influx of inventory to flood the market more quickly than it can absorb. That’s what we call a housing crash, but more on that later.

Luxury Real Estate

Buyers of luxury homes tend to be less rate-sensitive as a high percentage tend to buy in cash, and others can sustain paying high rates in the short term while they wait for rates to come down and refinance. “In the third quarter, 42.5 percent of high-end homes were acquired in all cash transactions[…] This time last year, only 34.6 percent of the luxury sales were all cash.” [Robb Report] In these price brackets, buyers tend to utilize mortgages as a leverage instrument rather than their sole mechanism to get their foot on the rung of the property ladder. For that reason, the luxury market is outperforming lower price tiers in many ways.

Over the last year, luxury home prices in the U.S. increased by 9%.

As the price of luxury homes continues to outpace the overall market, there’s been an increase in inventory, too. Active listings were up almost 3 percent compared to 2022, and new listings grew 0.3 percent. On the other hand, non-luxury listings saw a 20.8 percent drop in supply, while new listings fell 22 percent, the lowest third-quarter level in over a decade. [Robb Report]

The luxury market sector also tends to be much more localized than the general housing market. The New York City luxury market typically shows a high correlation with completions of new luxury developments, while in other markets, such as South Florida, buyers are attracted to vacation homes, and in many areas, buyers seek tax and regulatory benefits.

NYC Housing Market

New York City is a special market — both in terms of actual market dynamics and because it is where SERHANT. was born. For these reasons, I will be dedicating a section of this report to NYC residential real estate.

The recent StreetEasy poll conducted by The Harris Poll revealed that nearly one-third of homes listed in NYC don’t sell, an alarming statistic upon first consideration, but my interpretation is that this illustrates more about consumer behavior than market performance. Homes take longer to sell in NYC versus the national average due to higher average price points and the uniqueness of our properties. The reasons a seller would choose to take their property off the market are numerous, and even more so, and more common, in NYC. For instance, only one-third of homes are owner-occupied in NYC versus two-thirds nationally, meaning that for over 65% of property owners, their NYC property is part of their larger financial strategy and does not represent the place they call home. It’s easy to imagine various scenarios in which an investor may change winds easily about whether to sell a property. Additionally, for those sellers who do occupy the properties they’re listing, it can be very difficult to find a replacement property in our low-inventory environment. Of course, factors such as interest rates, regulatory fees and changes, and buyer perception of the listing and its price also play major roles in whether a property sells.

To provide more clarity into the state of NYC’s real estate market, let’s drill into the data. SERHANT.’s very own Director of Research, Coury Napier, released the latest of our quarterly reports in early November detailing the resale and new construction markets in Manhattan and Brooklyn, respectively, as well as a mid-year report which was released in July on the SERHANT. Signature ultra-luxury market.

In Manhattan, as is the case with the rest of the country, homeowners are resisting higher rates and choosing to stay put in their current homes on which they hold low-rate loans. Consequently, there’s been a 17.3% decrease in new listings YoY. Because of the low inventory, prices are sitting near record highs, with the average sold unit price at $2,016,887 in the 3rd Quarter, a 4.5% increase year over year. The end of the quarter saw a surge in new listings, one possible explanation for which is that homeowners are looking to leverage their high property values. For more detailed insight, refer to SERHANT.’s Q3 Manhattan Market Report.

As for Manhattan’s new development activity, despite trailing behind 2022’s robust performance, the market remains resilient in terms of strong pricing trends. New development sales declined 14% year-over-year, lower than but on trend with the decline in sales activity across the market. Nonetheless, the average price of signed contracts surged by 20%, surpassing the resale market, reaching an impressive $3,666,872. This price surge is primarily driven by the increasing demand for larger units, with 3- and 4-bedroom signed activity rising by 16.4% and an impressive 62.5%, respectively. Looking ahead, the New Development sector is poised for sustained demand, particularly as the supply in the resale market remains limited. For more detailed information, review our Q3 Manhattan New Development Market Report.

As the popularity of the Brooklyn market continues to grow, it is seeing faster price appreciation than Manhattan, with listings falling more sharply. Listings in the borough fell 18% from this period last year and over 20% from the previous quarter. The median price of available units rose 7.6% from 2022. Sales during the third quarter fell 31.0% from last year as high rates and prices impacted potential homebuyers. Check out our Q3 Brooklyn Market Report for more info.

Brooklyn's new developments saw a 9% increase in sales price and a 13.1% decline in sales YoY. The $3 million plus market recorded 20 sales, marking a substantial 53.8% increase compared to the same period in 2022, while the market priced at $500k and less took the biggest hit year over year, falling 34.3%. Greenpoint and Williamsburg showed increasing popularity evident from a 44% surge in signed contracts compared to the previous year. Furthermore, the average price in the North Brooklyn market saw a 6.1% YoY increase. At the quarter’s end, 379 new development listings were on the market, reflecting a 15.6% reduction from the same time last year. For more detailed information, look at our Q3 Brooklyn New Development Report.

Signature

Lastly, our SERHANT. Signature Mid-Year report provides an in-depth look at $10 million-plus super-prime property trades in New York City. Steady activity levels continue in New York City’s luxury market, though they were expectedly down YoY compared to the busy first half of 2022. The overall market showed a return to pre-pandemic trends following the outlier years of 2021 and 2022, and the upper price points appear to be following that path as well. Historical trends indicate a strong correlation between luxury sector performance and the closing of new developments, and we witnessed several high-end new development closings keep prices elevated through the first six months of the year.

In summary, although New York City stands out in median price, average price per square foot, unique market segments, and extreme locality in trends — it has, in general, followed the patterns of the rest of the country in reaction to high interest rates — home sales are down, but prices are hovering near all-time highs due to constrained inventory.

Interest Rates

Interest rate changes caused significant shifts in the real estate market’s pulse this year. Rates may start to settle soon, in fact, they may even be doing so now. The U.S. consumer has seemingly learned to accept that sub-4% mortgage rates are a thing of the past. I anticipate mortgage rates reaching around 6-6.5% by the end of 2024 and gradually stabilizing between 5-5.5% in the long term, but not before 2025, as the Fed eases its tightening policy. Rates normalizing will likely involve a somewhat volatile process with peaks and valleys. Rushes are expected when rates drop. I firmly believe that rate reductions will lead to increased home prices, following the historical norm. In fact, it’s rare for home prices to fall substantially over time, regardless of rate activity, as seen in the plot graph below.

Mortgage demand compared to mortgage rates [Mortgage Daily News]

The NAR Affordability Index reported that home buyers faced the worst affordability conditions in nearly four decades. Affordability is not determined only by mortgage rates and home prices but also by wages and inflation, so it’s best that rates reduce slowly to avoid erasing any positive gains that rate reductions have on affordability via stimulated price growth while inflation falls and, hopefully, wages catch up.

Notable, however, is the common misconception that mortgage rates are tied to the Fed rate — the Fed rate does have an indirect influence on mortgage interest rates, but mortgage rates are more closely tied to bond prices and fluctuate constantly depending on many factors. (For more on the Fed rate, check out the U.S. Economic Update section of this letter if you haven’t already.) The Fed rate remains stable between meetings and effectively dictates the cost of money. In the U.S., we became accustomed to rock-bottom Fed rates in the wake of the last financial crisis, and while that had its perks, it presented dangers as well. If the federal funds effective rate is at or near 0.0%, the Fed has substantially diminished power to improve financial conditions when and if we find ourselves in a recession. Therefore, it’s beneficial to the economy to have room for rates to fall.

Potential for a Housing Crash

In order to have a crash, it would first be necessary to see an oversupply of homes for sale compared to homebuyer demand. That’s why consumers fear heightened foreclosure activity, especially those who remember the headlines and the pain felt by homeowners in the Great Recession of 2008. Foreclosure activity tends to spike when the economy is in trouble. When a large number of homeowners are forced into short sales and/or foreclosures, and those homes all hit the market at the same time, we end up with a glut of supply. When this happens, there tends not to be enough demand to absorb the supply because of poor economic conditions. In that case, prices get driven down and eradicate homeowner equity as comparable homes sell at discounts.

Today, 49% of mortgage-owned residential properties in the U.S. are equity-rich. [Attom] “In other words, the combined estimated market values for those properties were worth at least double the estimated loan balance amounts, providing homeowners a safe cushion from foreclosure.” [Forbes] And that’s not including the 37% of U.S. homes that do not have an outstanding mortgage against them at all. In addition to the high equity levels of U.S. homeowners, the vast majority of existing mortgages are 30-year fixed-rate loans with low interest rates held by highly qualified buyers, thanks to the 2010 Qualified Mortgage rule. This rule was implemented after the 2008 financial crisis proved to be a result of, in part, subprime loans made to under-qualified buyers, many of whom used an adjustable rate mortgage that they could no longer afford when rates shot up.

There has been an influx of headlines about foreclosures in the news lately. In September, foreclosure filings were up 11% from August and 18% from last year, and foreclosure completions were up 29% from the previous month and 24% from a year ago. Foreclosure starts are nearly back to where they were two years ago when the federal government lifted a pandemic-related moratorium on most foreclosure filings, according to Attom. While foreclosure rates have been rising, they are rising to pre-pandemic levels before foreclosure moratoriums were put in place, and many are the result of foreclosures that were already in the pipeline at that time, which had been suspended in March of 2020. Before the pandemic, foreclosure rates were near all-time lows and nowhere in the stratosphere of presenting cause for concern about a housing crash. In Q3 of 2023, 1.9% of all homes had negative equity, or 1.1 Million homes in the U.S. By comparison, Negative equity peaked at 26% of mortgaged residential properties in the fourth quarter of 2009 [CoreLogic] while the Great Recession was peaking.

Loan-to-Value Ratio (LTV)

This chart shows national homeowner equity distribution across multiple LTV segments. [CoreLogic]

Of course, one doesn’t lose their home to foreclosure simply because they have negative equity. They also have to stop paying their mortgage and fail to recover for a period of time. This is known as loan performance, and as negative equity numbers are low, the performance of loans is in a solid position. In August 2023, 2.6% of mortgages were delinquent by at least 30 days or more, including those in foreclosure. This represents a 0.2% decrease in the overall delinquency rate compared with August 2022. The share of U.S. mortgages that fell into serious delinquency — representing borrowers who are three months late on payments — dropped to the lowest level in nearly 25 years in August, at 0.9%. [Corelogic]

Indeed, U.S. homeowners are in a better position now than they were at the beginning of 2023 when prices dropped in response to rising mortgage rates. The national increase in average home prices since then has gained the typical homeowner nearly $14,000 in home equity. This is especially notable for those who bought homes using higher rates in mid-2022. As for the homeowners who do find themselves underwater on their loans, “[...]they are not necessarily concentrated in markets that have seen the largest price declines, as negative equity also depends on the down payment. Natural disasters and related risks also play a substantial role in home equity changes.” -Selma Hepp, Chief Economist for CoreLogic [CoreLogic]

In other words, foreclosure activity isn’t the only thing that could cause inventory to peak. It’s possible that in certain areas with a high rate of investor holdings, inventory could spike if investors chose to offload their holdings at the same time. A dwindling population could be a cause of oversupply — but not one of concern in the U.S. Overbuilding could also cause oversupply, but in the most desirable locales in the U.S., there is not adequate land available to build to oversupply compared to demand.

On the demand side, we have seen not only enduring demand from U.S. homebuyers but also the return of overseas capital investments in real estate, including sight-unseen property purchases. As economies across the globe face their own headwinds, U.S. real estate is seen as a safe haven, especially in the long term, and while we saw a drop-off in foreign investors in U.S. real estate throughout the pandemic, that trend has reversed. We also continue to see strong demand from buyers who are less rate-sensitive, such as higher-net-worth individuals and investors, who either pay in cash or can sustain the short-term pain of higher interest rates to secure properties at today’s values and refinance when rates are lower. This high demand is yet another hedge against the probability of a housing crash.

A fairly new topic of conversation around housing equity risks, however, revolves around climate change – and it is a topic worthy of concern when you consider the data. Estimates indicate that the average number of billion-dollar climate events annually has quadrupled on average since the 1980-1999 time period. [PWC 2024 Emerging Trends in Real Estate]

A recent report from the nonprofit First Street Foundation suggests that escalating climate risk has likely overvalued approximately one-fourth of residential properties in the U.S. This estimation, covering around 39 million homes nationwide, is primarily attributed to the growing uncertainties surrounding climate hazards like wind, wildfire, and flood risks. Matthew Eby, the founder of First Street Foundation, emphasizes that as this climate risk becomes more apparent, property values are expected to decline. Observed transaction data indicates that as risk becomes realized and awareness increases, property values tend to decrease. The repercussions are already evident in Florida, where a surge in extreme weather-related disasters prompted 15 major insurers, including Farmers, to announce their intention to withdraw from the state over the past year. [Newsweek] It's crucial to note that the potential value losses are highly regional, sometimes varying even from one block to another.

Today, hyper-local concerns, which may be highly political, pose the biggest risk to property values. And while the chance of recession is up in the air, a national housing burst remains highly unlikely. I can’t say the same for our student debt or credit card debt crises, though.

The AI Revolution

If you’re alive and living on the grid in 2023, then you’re no stranger to the conversation around the AI revolution. The Collins Dictionary word of the year is AI. The conversation about AI technology spiked this year with the launch of ChatGPT, and while AI technology is not a new conversation, ChatGPT and other language, image, and video-generative tools have exploded in popularity over the last year. The impact has been undeniable.

Without a doubt, AI is one of the most important developments of our time, and as a technology that is still very much in its development phase, it is also mired with problems. From writing and propagating fake news to falsely impersonating people to issues with gender disparities in adoption rates and, most importantly, widespread discrimination issues, the field of AI has many hurdles to overcome to save itself and society from existential consequences. The U.S. and the world at large are beginning to work towards legislative solutions to AI’s many issues, some of which may help and others that may hinder the evolution of this revolutionary technology. The U.S.’s recent Executive Order on the Safe, Secure, and Trustworthy Development and Use of Artificial Intelligence states that “harnessing AI for good and realizing its myriad benefits requires mitigating its substantial risks. This endeavor demands a society-wide effort that includes government, the private sector, academia, and civil society.”

SERHANT. is founded on the bedrock of leveraging emerging technologies, and as early adopters, we exist on the cutting edge of the use cases of these tools. We are taking action armed with the absolute certainty that the paradigm shift necessary for the brokerage of the future to succeed is to utilize technology to reduce the number of screens an agent must interact with and the number of hours at a desk an agent must spend to get their job done.

While everyone else is asking the question, “How can AI make the agent better,” SERHANT. is asking, “How can we use AI to build a better brokerage?”

The real estate industry has adopted technologies in novel ways over the years, including 3D property tours, VR showings, virtual staging and remodeling, automated property valuations, e-signatures, transaction management, scheduling, task automation, chatbots, predictive analytics, and more. These tools have required agents to learn and implement innumerable operating systems that rarely synchronize with one another smoothly, ultimately resulting in frustration and much more time spent in front of a device. This puts agents in a position of spending too little time on their business-building strategies as they have been required to spend more time working in their business to serve their current clients with these myriad tools.

Now, the AI revolution has brokerages and real estate tech firms falling all over themselves to release the next new, shiniest object that leverages large language models and incorporates them into chatbots, CRMs, and the like… more screens! Mark my words: they’re making the same mistakes in boardrooms across the country right now that they have been making for the last decade; they’re solving problems that don’t exist with solutions agents didn’t ask for in order to justify commission splits that agents don’t understand.

As our industry faces complicated challenges, now is not the time for brokerages to bank on the narrative that they can and will make agents better with the promise of technological solutions. We must instead serve our brilliant agent community from the top down by investing and building solutions that make their work and their lives easier and more streamlined while empowering them to massively grow their businesses. There’s not another screen in the world that is going to accomplish that.

The question that guides us as leaders leveraging emerging technologies must always be, “What actual problem are we solving?” We must provide practical solutions that allow us to spend more time with our communities and doing deep work and less time managing functions that can and should be automated even more intuitively than they can be today. Dealing with the caliber of clients that SERHANT. agents serve necessitates a level of service that cannot be accomplished without tremendous investment and laser-focus on agent and client needs, a concept that SERHANT. has built our business model around, and that most brokerages are unable and unwilling to commit to. Our promise at SERHANT. is the promise of ‘Brokerage 3.0’ – the brokerage of the future – and we have assembled the innovation infrastructure to learn, test, pilot, adapt, and scale across the country rapidly. We simply have the advantage of being faster and more agile than our competitors. We measure value by hours saved and deal sizes going up for our agents — a measure our agents can attest to being achieved in their partnership with us.

The industry headwinds that we face, such as active trade organization legislation, low housing inventory, high mortgage rates, and inflation increasing cost basis across the board, are already causing a changing of the guard in the world of real estate. The industry titans of the last 20 years are going to struggle to survive as they fail to adequately serve their agents and clients in the new landscape. SERHANT.’s disruptive model, which exists at the intersection of sales, media, education, and technology, was built to guarantee our seat at the table as the new guard takes its place, and we couldn’t be more excited to be there. May the best of us win.

SERHANT. Business Update

People

This year, SERHANT. has expanded operations from New York into six additional states, doubling (again) our agent headcount from 250 to 500. We now service the Charlotte, Lake Norman and Raleigh areas of North Carolina, Greenwich and New Cannan in Connecticut, Philadelphia, Lehigh Valley and New Hope in Pennsylvania, Bergen County and Jersey City/Hoboken in New Jersey, Hilton Head/Bluffton and Charleston in South Carolina, and in Florida our growth expanded service to Miami, Palm Beach, Tampa, Delray Beach, and Greater Florida. We opened a second 10,000-square-foot office in TriBeCa, Manhattan at 205 Hudson St. and our New York markets continue to grow outside of the city as well, with both the SERHANT. House Hamptons, and Long Island areas, now serving clients from offices in Northfork and the South Shore, continuing to grow.

Our expansion outside of NY currently represents nearly 40% of the firm’s agents and counting. In a very proud moment for me, in 2023 we saw independent brokerages flock to SERHANT., including Chris Bowes (The Network) in South Carolina, Trompeter Real Estate in New Jersey, and Prakas Real Estate in Delray Beach. We successfully filled our regional leadership team with Yasser Ponce in Florida, Michele Zyska in New Jersey, Elva Guerra in The Hamptons, and Stephen Calandrino in Pennsylvania. Additional agent leadership includes Christian Prakas in Delray Beach, Chris Bowes in South Carolina, Josh & Charlene Dearing also in South Carolina, and Andrea Desy & Michael Skokowski in Pennsylvania. We recently added Danielle Malloy, Jessica Lane, and Garvey Fox to helm our operation in Connecticut.

Our new markets pose great opportunities for our agents and their clients. The SERHANT. community facilitated over 500 referrals both nationally and internationally this year alone, including a $17 million listing in Central Park the Bogards will soon bring to market, as well as a $15.5 million land development deal referred from Long Island to South Carolina that just closed.

We currently have 113 SERHANT. employees spanning 21 states. As is one of our top priorities, we are continuing to nurture a culture of community and empowerment through regular town hall meetings, professional development through AMP! Hours, and our establishment of internship and fellowship programs. This year, we also enhanced our retirement benefits by offering an employer safe harbor match. At our core, we prioritize quality over quantity. Our focus is not merely on amassing a vast workforce, it’s about cultivating the nation’s most esteemed, high-performing, and exceptionally driven individuals. We are trailblazers, unwavering in our pursuit of attracting and fostering the best minds to empower our agents.

We created several new roles in 2023 and had the distinct pleasure of bringing on a number of key hires including Jason Barsi, General Counsel, formerly with Anywhere; Laura Youngbloom, Chief Revenue Officer, VENTURES, and; Elva Guerra, Office Manager, Hamptons.

Finally, inspired by our core value “Disrupt for Good,” our team made a charitable impact this year. In addition to our annual celebrations of Black History Month, Pride Month, and Hispanic Heritage Month, we launched our first annual SERHANT S.ERVES, a day of service across the organization during which the SERHANT. agents and staff gave back to our communities. Impacted charities include City Harvest (NY), Ronald McDonald House (PA), Neighbor to Neighbor (CT), Heart of the Hamptons (NY), His House Children's Home (FL), Neighborhood Hope Foundation (NC), Frazier Family Foster Care (SC) and many more. We helped over 10,000 people in one day!

Signature

This year Signature, our bespoke luxury buyer and listing platform for properties above $10 million, listed 75 custom-branded properties, including the Penthouse at Central Park Tower, currently listed for $195M, standing tall as the highest residential listing in the world, and the most expensive on-market residence in the United States. Our Signature listing inventory totaled nearly $1.3 billion this year, and many of these listings were in SERHANT.’s new markets that were just opened this year, including THIS beauty that was just listed in West Palm Beach for $39.9M.

Our Signature properties inspire, as evidenced by our STUDIOS film production team winning a 2023 SHORTY Award for their content featuring our Signature listings. According to an in-depth market analysis, we learned that in 2023, SERHANT. Signature branded properties sold at a 16% premium compared to other brokerages’ listings and spent 8% less time on the market. We will kick off 2024 with an impressive pipeline of Signature listings and will continue to break down the barriers posed by a challenging market with innovative and inventive solutions to sell properties in less time for more money than any other brokerage can.

New Development

As we continue to strengthen our New Development department, we are proud to announce the addition of two key executives to our team, further enhancing our capabilities in this dynamic market. Joel Dixon has joined us as the Director of Planning and Design, bringing a wealth of expertise to drive innovation and excellence in project development. Additionally, Felice Donatiello has assumed the Director of Business Operations for New Development role, ensuring seamless and efficient business processes.

We have successfully secured 20 new projects year-to-date, representing an impressive $1.426 billion in inventory. This year has been marked by a significant focus on pre-development projects slated for launch in 2024, positioning us for a robust, prosperous, and successful year ahead.

We are confident that these strategic additions to our team, coupled with our impressive project pipeline, will contribute to sustained growth and value creation for SERHANT. as a whole.

ID Lab

ID Lab is our in-house creative production studio that delivers smarter solutions to branding and marketing for our developers, sellers, and agents. This year, department staff grew by 30% to brand, launch, and support our agents in our expansion markets. To better support our agents, we launched a centralized dashboard for agent custom marketing and branding requests to streamline processes and deliver value faster than ever before.

As for our listing branding, ID Lab branded 75 Signature property listings ($10M+) this year and found that our Signature-branded properties sell faster than their competitors, and at a premium. We also took over and rebranded Kushner’s WyndMiami, our first new development in Miami, effectively tripling traffic.

The reach of SERHANT. is due in large part to the impeccable implementation of the principles of strong branding, and ID Lab, staffed with the industry’s best and brightest designers and strategists, is the culmination of our experience, knowledge, and focus on leveraging those principles to support the success of our agents and clients.

STUDIOS

STUDIOS, our in-house film production company, is celebrating another extraordinary year as the backbone of SERHANT.’s media component. Not only has our team continued to grow, expanding our presence, content creation, and social support into SERHANT.’s six new markets, we also created 384 agent-forward property tours and 100+ unique pieces of content for our new development partners.

On social media, the content of our agents and listings saw a 54% increase in total viewership from last year. On top of that, Studios launched a series of 23 new social video formats to feature our agents and listings in social-optimized ways. Our flagship media network, LISTED, created over 300 unique pieces of content, featuring over 45% of our SERHANT. agents on camera, and launched over 20 new social pilots, resulting in a staggering 51% increase in views. LISTED also grew its total social following by 40% this year, even earning us our 100K subscriber plaque on YouTube! One of our most popular features launched this year is a marketing campaign featuring our Signature listings and top-producing agents titled 'Through The Lens Of' which centers on property tours filmed and edited in the style of famous film directors.

Our dedication to creating high-quality engaging content won us yet another SHORTY Award for our Signature Content Suite and allowed us to produce and deliver sponsored content campaigns with Angi, Adobe, BMW, Curbio, and Chase. Our team is well poised for further expansion and even greater creativity as we grow to reach new heights alongside the brokerage.

Tech Department / ADX Team / Cyber Infrastructure

At SERHANT., our commitment to 'Brokerage 3.0' relies on our adeptness in technological innovation, forming the bedrock of our operations. In this era poised for a technological revolution, our objective is to design an ecosystem that minimizes, rather than amplifies, screen time. We aim to optimize user experiences during any necessary screen engagement. In 2023, we've made significant strides in achieving this goal:

2023 ADX Accomplishments:

SERHANT. GPT - we hold the accolade of being the first brokerage in the world to launch a listing feed-connected multi-modal generative AI toolkit for agents, including a marketing material creator, image creation and enhancement, and a custom chatbot.

Developed and launched SLAPI, the SERHANT. Listings API, enabling seamless connectivity of all SERHANT. market listing data to integrate with current and future apps & tools.

Extended the reach of our ADX global reach platform to more than 100 listing platforms in over 60 countries.

Launched S.RM - The SERHANT. Relationship Manager, our next-gen platform that combines CRM, email & social media marketing, deal-tracking, open house registration, tour sheets, and much more, with AI integration. Launching early Q1 of 2024.

Deployed an AI-powered cybersecurity system organization-wide to protect against threats in real-time and keep agents safe while blossoming further into the public eye.

Created the Business Intelligence Large Look Into the Overall Numbers of SERHANT. or BILLIONS tool, enabling holistic analysis and insight across all aspects of the organization to make decisions better and faster than ever before.

Established a partnership with the fastest-growing and award-winning video editing collaboration solution to enable our agents and Studios production team to work together seamlessly across our markets

The Real Deal magazine recognized SERHANT. as the leading AI-powered real estate brokerage and the earliest adopter of AI-powered tools for its agents. TRD also acknowledged our Chief Technology Officer, Ryan Coyne, as an authority and thought leader in the AI space, selecting Coyne as the lone real estate brokerage representative for a panel of AI early adopters and industry leaders.

Developed and launched our new website that cements SERHANT. as a national brokerage and fortifies our international brand further than ever, enabling SERHANT. agents to reach more clients than ever and encourage members of the public anywhere in our markets to choose our website as their primary MLS search and SERHANT. exclusive listing search experience.

Achieved midsize Enterprise status through partnerships with multiple organizations, enhancing our ability to provide agents with superior service, courtesy of significantly powerful feature upgrades for our agent operations, software engineering, and creative teams.

Selected to represent the residential real estate industry in a private roundtable discussion with Google insiders on generative AI and its perceived and desired impact on our industry.

2023 ADX Notable Stats:

SERHANT. GPT Launch

Usage Statistics: Nearly 500 agents using the S.GPT AI toolkit.

Efficiency Metrics: On average, S. Agents are saving 6 hours per week with marketing material creation, image enhancement, etc.

User Feedback: S. Agents report that S. GPT has been a transformative game-changer for them.

SLAPI Development and Launch

Integration Count: 7 apps & tools successfully integrated with SLAPI.

Data Flow Metrics: Our ability to achieve full integration of all SERHANT. listings into software projects and tools is down to hours instead of days or weeks.

ADX Global Reach Platform Expansion

Listing Reach: Increase in listings displayed on global platforms - organic reach is up 24% year over year

Market Penetration: Number of new countries reached via listing syndication - 63

AI-Powered Cybersecurity System

Threat Detection: Number of threats detected and neutralized - SERHANT. receives an average of 1.3 million emails in each 30-day period examined, our security has captured and eliminated a combined 700K malicious or fraudulent emails in 2023. The price of worldwide fame, eh?

System Reliability: Uptime percentage or reliability metrics - we enjoyed 100% outward-facing operational uptime and 99.99% internally-facing operational uptime in 2023.

Video Editing Collaboration Partnership

Collaboration Efficiency: Projects involving editors and capturers across markets are turning around nearly twice as fast.

New Website Launch:

User Engagement: Prior to the massive increase in value proposition to the public, SERHANT. averaged more than 60K unique site visitors per month, which we expect to drastically increase with the functionality gains for agents and their clients that we just launched.

Participation in Google Roundtable:

Insight Contribution: Security, scaling, practical applications, capabilities of Google Cloud Platform (we develop on Microsoft Azure, as well as Google Cloud Platform).

VENTURES - Education

In the world of sales training, our ed-tech division, VENTURES, stands as a formidable force. We provide courses, a membership, coaching programs, and events with over 21,500 enrollees in 110 countries, marking a +60% growth in enrollment since we reported 13,500 enrollees in 2022's letter. Moreover, we've experienced a 60% YoY increase in revenue, up from 44% in 2022.

This year, VENTURES initiated the launch of our standalone membership for real estate agents, creating bimonthly mini-courses, offering almost daily live programming, and presenting hundreds of unique guides and templates. Our life-changing programs took the spotlight at this year’s Sell It 2023 conference, our largest event yet, hosted in Miami for 500 amazing salespeople from all over the world.

In 2024, we are actively expanding our leadership team to foster growth and extend beyond our core real estate audience. We are actively pursuing our mission to democratize sales skills, enabling everyone to achieve their full potential. Sales propels all careers, opens doors in life, and is one of the most powerful drivers of the global economy.

Public Relations